deferred sales trust irs

Tax EIN Driver License 4 jours Update January 19 2021 Sell CVVDeadFullzGiftCard 11 jours big business a répondu au sujet HOT 2021 Sell Info fullz SSN Dob DL - Info Fullz Company. The trustee is then tasked with.

Deferred Sales Trust Real Estate Tax Strategy

The Deferred Sales Trust is a made up name and will not be found on the tax code.

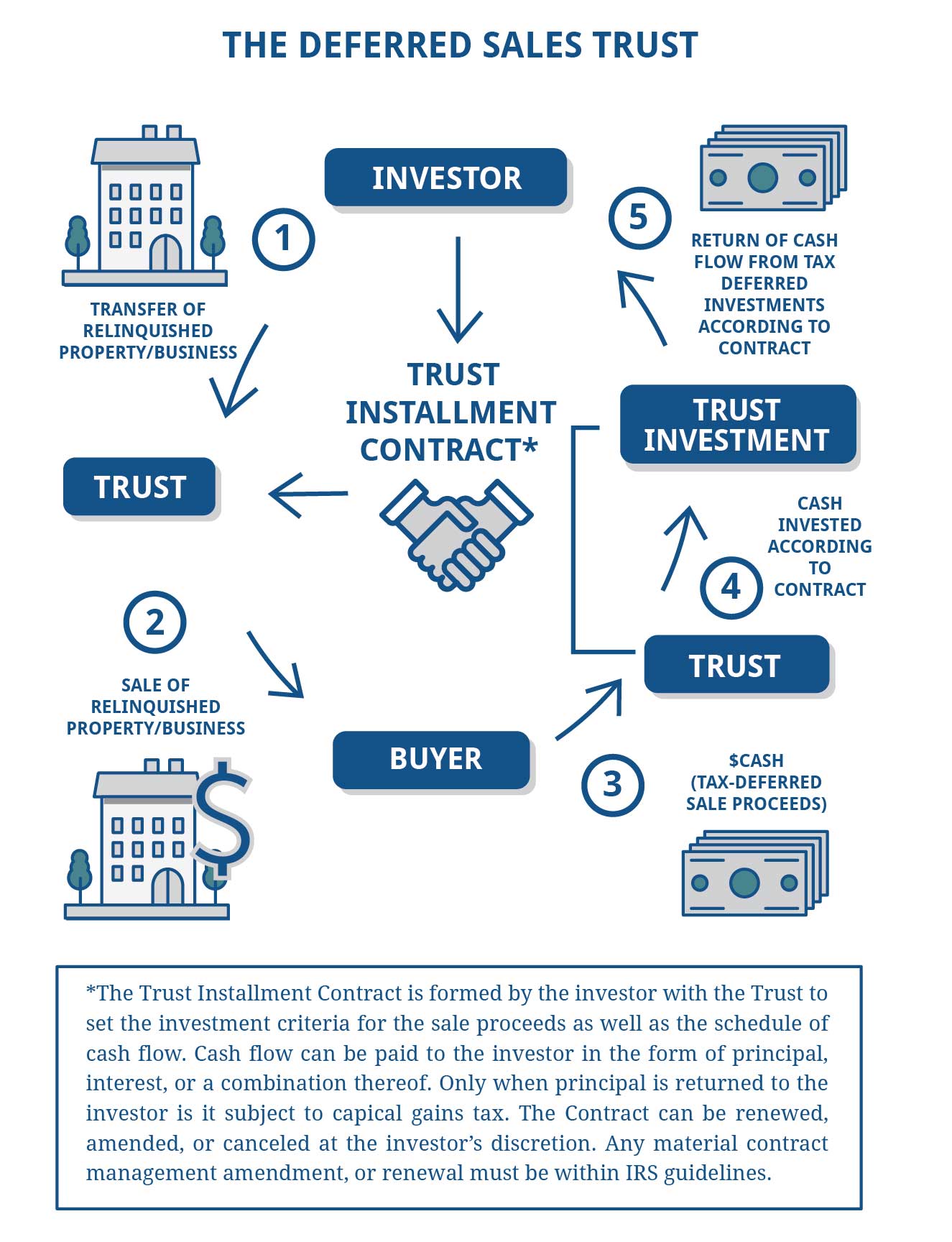

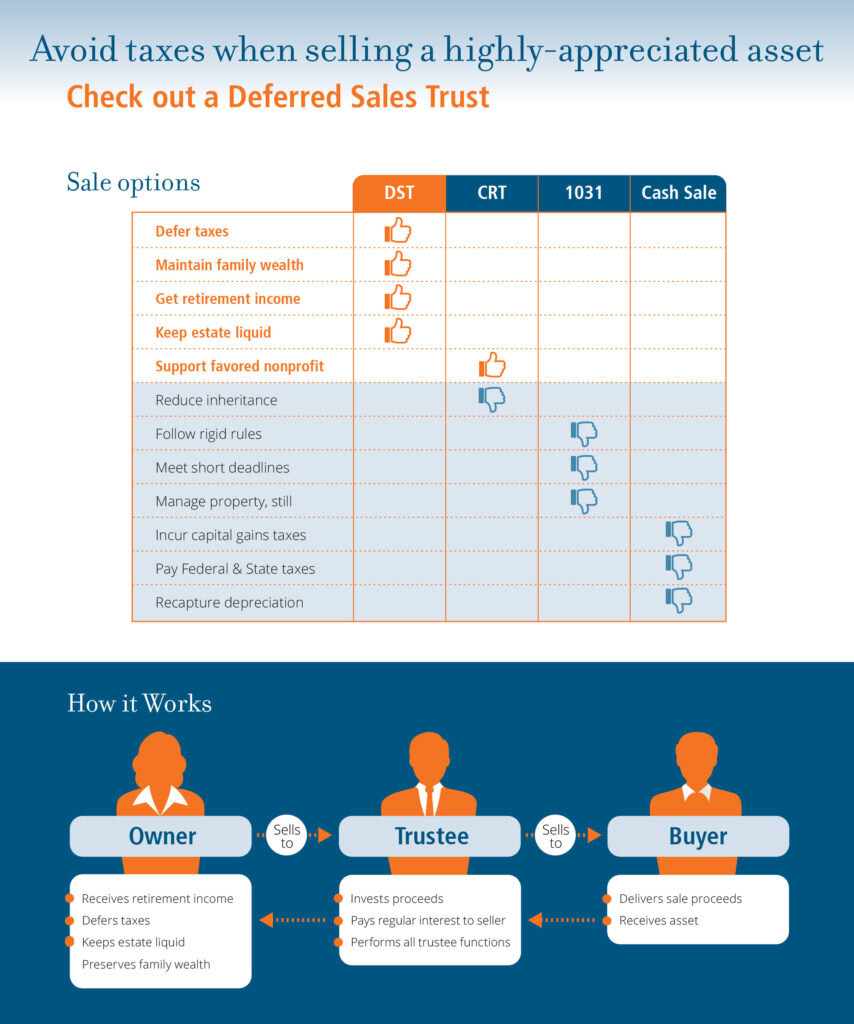

. Capital gains refer to the profit you made off your. This means that the gain is deferred until a taxable sale or exchange occurs. The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property.

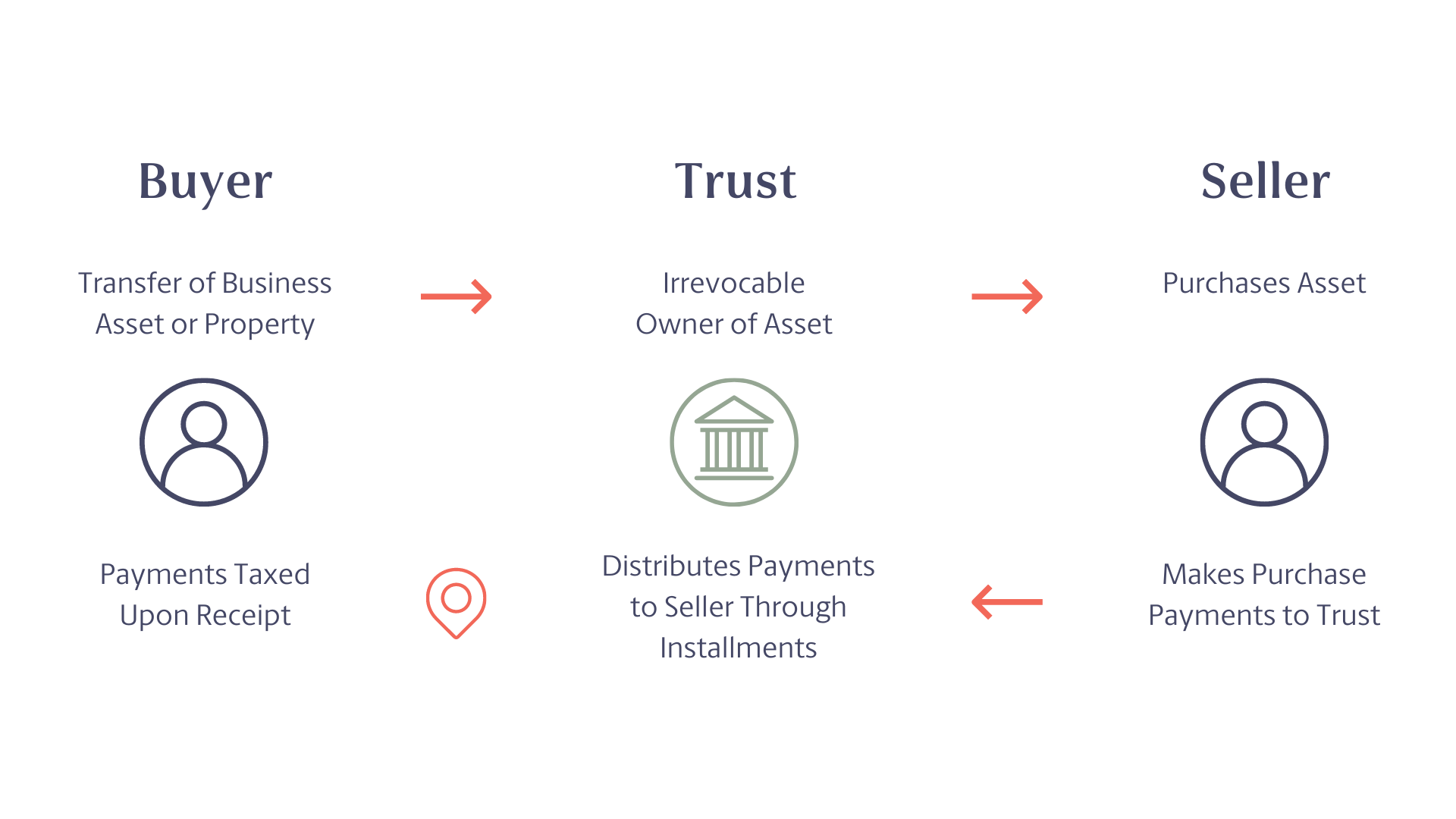

There is an IRS Tax Code 453. A deferred sales trust is a third-party entity managed by a trustee who will purchase the home from the original owner through an installment sales contract. Thats where the Deferred Sales Trust comes in.

The concept is a lot less exciting as. The deferred sales trust is the replacement for the private annuity trust. The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children.

A deferred sales trust is a legal agreement between an investor and a third-party trust in which the investors real estate is sold to the trust in exchange for predetermined future. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. As in a private annuity trust title is transferred to the trustee who then sells the property and puts the.

The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. An irrevocable trust is a trust which by its terms cannot be modified amended or revoked. For tax purposes an irrevocable trust can be treated as a simple complex or.

It is stated on this section that an installment sale as a. DST - Deferred Sales Trust. Those of us with clients that own businesses highly appreciated stock commercial or residential investment real estate assets we often find those clients who.

A Deferred Sales trust allows highly appreciated investors to liquidate and reinvest in real estate or a business on their own timetable or reallocate for income while delaying capital gains. Binkele and attorney CPA Todd Campbell. In a Deferred Sales Trust or Monetized Installment Sale an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of loan or.

A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed.

Advanced Planning Deferred Sales Trusts The Quantum Group

Rental Property Exit Plan The Deferred Trust Sales

Deferred Sales Trust Introduction Jrw Investments

Maximizing The Potential Value Of An Asset Sale Like A Business Or Real Estate Deferred Sales Trusts Aloha Wealth Partners

Leveraging The Deferred Sales Trust To Defer Capital Gains

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Introduction Jrw Investments

Benefits And Drawbacks Of Using The Deferred Sales Trust

Deferred Sales Trust Irs Ruling Youtube

Overcoming False Beliefs Of The Deferred Sales Trust Youtube

Deferred Sales Trust Defer Capital Gains Tax

Capital Gains Taxes Are Voluntary Wealth Legacy Group Inc

Deferred Sales Trust The 1031 Exchange Alternative

Pros And Cons Of A Deferred Sales Trust Part 2 Youtube

Deferred Sales Trust O Connell Investment And Insurance Services

Why The Irs Allows Deferred Sales Trusts And How You Can Benefit Reef Point Llc

91 How To Defer Capital Gains With The Deferred Sales Trust With Brett Swarts Everything Real Estate Investing